Page 9 - Venafi - 2021 Benefit Guide - CA

P. 9

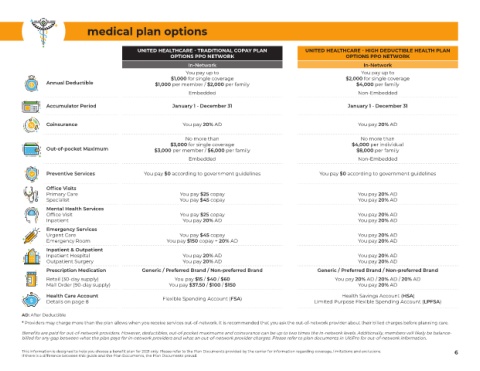

medical plan options

UNITED HEALTHCARE - TRADITIONAL COPAY PLAN UNITED HEALTHCARE - HIGH DEDUCTIBLE HEALTH PLAN

OPTIONS PPO NETWORK OPTIONS PPO NETWORK

In-Network In-Network

You pay up to You pay up to

$1,000 for single coverage $2,000 for single coverage

Annual Deductible $1,000 per member / $2,000 per family $4,000 per family

Embedded Non-Embedded

Accumulator Period January 1 - December 31 January 1 - December 31

Coinsurance You pay 20% AD You pay 20% AD

No more than No more than

$3,000 for single coverage $4,000 per individual

Out-of-pocket Maximum $3,000 per member / $6,000 per family $8,000 per family

Embedded Non-Embedded

Preventive Services You pay $0 according to government guidelines You pay $0 according to government guidelines

Office Visits

Primary Care You pay $25 copay You pay 20% AD

Specialist You pay $45 copay You pay 20% AD

Mental Health Services

Office Visit You pay $25 copay You pay 20% AD

Inpatient You pay 20% AD You pay 20% AD

Emergency Services

Urgent Care You pay $45 copay You pay 20% AD

Emergency Room You pay $150 copay + 20% AD You pay 20% AD

Inpatient & Outpatient

Inpatient Hospital You pay 20% AD You pay 20% AD

Outpatient Surgery You pay 20% AD You pay 20% AD

Prescription Medication Generic / Preferred Brand / Non-preferred Brand Generic / Preferred Brand / Non-preferred Brand

Retail (30-day supply) You pay $15 / $40 / $60 You pay 20% AD / 20% AD / 20% AD

Mail Order (90-day supply) You pay $37.50 / $100 / $150 You pay 20% AD

Health Care Account Flexible Spending Account (FSA) Health Savings Account (HSA)

Details on page 8 Limited Purpose Flexible Spending Account (LPFSA)

AD: After Deductible

* Providers may charge more than the plan allows when you receive services out-of-network. It is recommended that you ask the out-of-network provider about their billed charges before planning care.

Benefits are paid for out-of-network providers. However, deductibles, out-of-pocket maximums and coinsurance can be up to two times the in-network levels. Additionally, members will likely be balance-

billed for any gap between what the plan pays for in-network providers and what an out-of-network provider charges. Please refer to plan documents in UltiPro for out-of-network information.

This information is designed to help you choose a benefit plan for 2021 only. Please refer to the Plan Documents provided by the carrier for information regarding coverage, limitations and exclusions. 6

If there is a difference between this guide and the Plan Documents, the Plan Documents prevail.