Page 8 - Venafi - 2021 Benefit Guide - CA

P. 8

important info about medical coverage

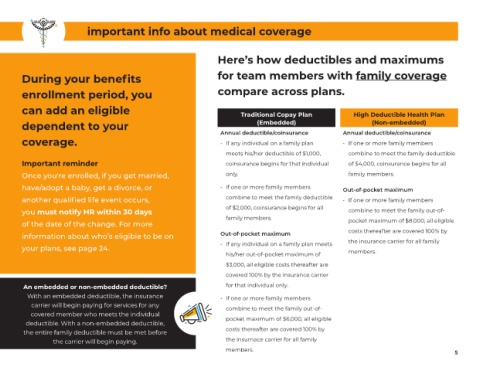

Here’s how deductibles and maximums

During your benefits for team members with family coverage

enrollment period, you compare across plans.

can add an eligible Traditional Copay Plan High Deductible Health Plan

dependent to your (Embedded) (Non-embedded)

Annual deductible/coinsurance Annual deductible/coinsurance

coverage. • If any individual on a family plan • If one or more family members

meets his/her deductible of $1,000, combine to meet the family deductible

Important reminder coinsurance begins for that individual of $4,000, coinsurance begins for all

Once you're enrolled, if you get married, only. family members.

have/adopt a baby, get a divorce, or • If one or more family members Out-of-pocket maximum

another qualified life event occurs, combine to meet the family deductible • If one or more family members

you must notify HR within 30 days of $2,000, coinsurance begins for all combine to meet the family out-of-

family members. pocket maximum of $8,000, all eligible

of the date of the change. For more

information about who’s eligible to be on Out-of-pocket maximum costs thereafter are covered 100% by

the insurance carrier for all family

your plans, see page 24. • If any individual on a family plan meets

his/her out-of-pocket maximum of members.

$3,000, all eligible costs thereafter are

covered 100% by the insurance carrier

An embedded or non-embedded deductible? for that individual only.

With an embedded deductible, the insurance • If one or more family members

carrier will begin paying for services for any combine to meet the family out-of-

covered member who meets the individual pocket maximum of $6,000, all eligible

deductible. With a non-embedded deductible,

the entire family deductible must be met before costs thereafter are covered 100% by

the carrier will begin paying. the insurnace carrier for all family

members. 5