Page 9 - Venafi - 2021 Benefit Guide - CA

P. 9

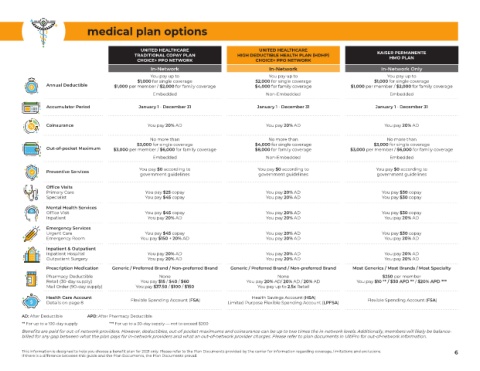

medical plan options

UNITED HEALTHCARE UNITED HEALTHCARE

TRADITIONAL COPAY PLAN HIGH DEDUCTIBLE HEALTH PLAN (HDHP) KAISER PERMANENTE

HMO PLAN

CHOICE+ PPO NETWORK CHOICE+ PPO NETWORK

In-Network In-Network In-Network Only

You pay up to You pay up to You pay up to

$1,000 for single coverage $2,000 for single coverage $1,000 for single coverage

Annual Deductible $1,000 per member / $2,000 for family coverage $4,000 for family coverage $1,000 per member / $2,000 for family coverage

Embedded Non-Embedded Embedded

Accumulator Period January 1 - December 31 January 1 - December 31 January 1 - December 31

Coinsurance You pay 20% AD You pay 20% AD You pay 20% AD

No more than No more than No more than

$3,000 for single coverage $4,000 for single coverage $3,000 for single coverage

Out-of-pocket Maximum $3,000 per member / $6,000 for family coverage $8,000 for family coverage $3,000 per member / $6,000 for family coverage

Embedded Non-Embedded Embedded

Preventive Services You pay $0 according to You pay $0 according to You pay $0 according to

government guidelines government guidelines government guidelines

Office Visits

Primary Care You pay $25 copay You pay 20% AD You pay $30 copay

Specialist You pay $45 copay You pay 20% AD You pay $30 copay

Mental Health Services

Office Visit You pay $45 copay You pay 20% AD You pay $30 copay

Inpatient You pay 20% AD You pay 20% AD You pay 20% AD

Emergency Services

Urgent Care You pay $45 copay You pay 20% AD You pay $30 copay

Emergency Room You pay $150 + 20% AD You pay 20% AD You pay 20% AD

Inpatient & Outpatient

Inpatient Hospital You pay 20% AD You pay 20% AD You pay 20% AD

Outpatient Surgery You pay 20% AD You pay 20% AD You pay 20% AD

Prescription Medication Generic / Preferred Brand / Non-preferred Brand Generic / Preferred Brand / Non-preferred Brand Most Generics / Most Brands / Most Specialty

Pharmacy Deductible None None $250 per member

Retail (30-day supply) You pay $15 / $40 / $60 You pay 20% AD/ 20% AD / 20% AD You pay $10 ** / $30 APD ** / $20% APD ***

Mail Order (90-day supply) You pay $37.50 / $100 / $150 You pay up to 2.5x Retail

Health Care Account Flexible Spending Account (FSA) Health Savings Account (HSA) Flexible Spending Account (FSA)

Details on page 8 Limited Purpose Flexible Spending Account (LPFSA)

AD: After Deductible APD: After Pharmacy Deductible

** For up to a 100-day supply *** For up to a 30-day supply — not to exceed $200

Benefits are paid for out-of-network providers. However, deductibles, out-of-pocket maximums and coinsurance can be up to two times the in-network levels. Additionally, members will likely be balance-

billed for any gap between what the plan pays for in-network providers and what an out-of-network provider charges. Please refer to plan documents in UltiPro for out-of-network information.

This information is designed to help you choose a benefit plan for 2021 only. Please refer to the Plan Documents provided by the carrier for information regarding coverage, limitations and exclusions. 6

If there is a difference between this guide and the Plan Documents, the Plan Documents prevail.