Page 11 - Venafi - 2021 Benefit Guide - CA

P. 11

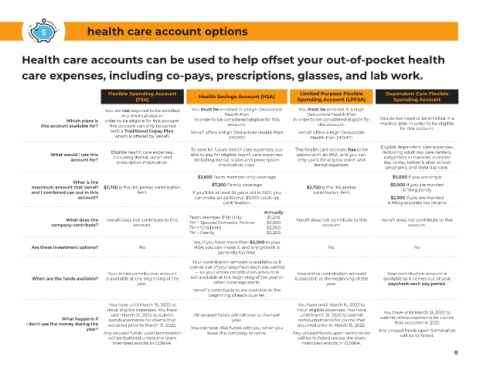

health care account options

Health care accounts can be used to help offset your out-of-pocket health

care expenses, including co-pays, prescriptions, glasses, and lab work.

Flexible Spending Account Health Savings Account (HSA) Limited Purpose Flexible Dependent Care Flexible

(FSA) Spending Account (LPFSA) Spending Account

You are not required to be enrolled You must be enrolled in a High Deductible You must be enrolled in a High

in a medical plan in Health Plan Deductible Health Plan

Which plans is order to be eligible for this account. in order to be considered eligible for this in order to be considered eligible for You do not need to be enrolled in a

this account available for? This account can only be paired account. this account. medical plan in order to be eligible

for this account.

with a Traditional Copay Plan, Venafi offers a High Deductible Health Plan Venafi offers a High Deductible

which is offered by Venafi. (HDHP) Health Plan (HDHP)

Eligible dependent care expenses,

To save for future health care expenses, but This health care account has to be

Eligible health care expenses, including adult day care centers,

What would I use this including dental, vision and also to pay for eligible health care expenses, paired with an HSA, and you can babysitters or nannies, summer

account for? including dental, vision and prescription only use it for eligible vision and

prescription medication. day camp, before & after school

medication, now. dental expenses.

programs, and child day care.

$3,600 Team member-only coverage $5,000 If you are single

What is the

maximum amount that Venafi $2,750 is the IRS pretax contribution $7,200 Family coverage $2,750 is the IRS pretax $5,000 If you are married

& filing jointly

and I combined can put in this limit If you’ll be at least 55 years old in 2021, you contribution limit

account? can make an additional $1,000 catch-up $2,500 If you are married

contribution. & filing separate tax returns

Annually

Team Member (TM) Only $1,200

What does the Venafi does not contribute to this Venafi does not contribute to this Venafi does not contribute to this

company contribute? account. TM + Spouse/Domestic Partner $2,500 account. account.

TM + Child(ren) $2,500

TM + Family $3,200

Yes, if you have more than $2,000 in your

Are there investment options? No HSA, you can invest it, and any growth is No No

generally tax free.

Your contribution amount is available as it

comes out of your paycheck each pay period

Your entire contribution amount — so your entire contribution amount is Your entire contribution amount Your contribution amount is

When are the funds available? is available at the beginning of the not available at the beginning of the year or is available at the beginning of the available as it comes out of your

year. when coverage starts. year. paycheck each pay period.

Venafi's contributions are available at the

beginning of each quarter.

You have until March 15, 2022 to You have until March 15, 2022 to

incur eligible expenses. You have incur eligible expenses. You have

until March 31, 2022 to submit All unused funds will roll over to the next until March 31, 2022 to submit You have until March 31, 2022 to

What happens if reimbursements for claims that year. reimbursements for claims that submit reimbursements for claims

I don’t use the money during the occurred prior to March 15, 2022. occurred prior to March 15, 2022. that occurred in 2021.

year? You can take HSA funds with you when you Any unused funds upon termination

Any unused funds upon termination leave the company or retire. Any unused funds upon termination will be forfeited.

will be forfeited unless the team will be forfeited unless the team

members enrolls in COBRA. members enrolls in COBRA.

8